Step-by-step guide to file GSTR-06 on the GST Portal/ GSTN:

Step 1: Login to

GST Portal.

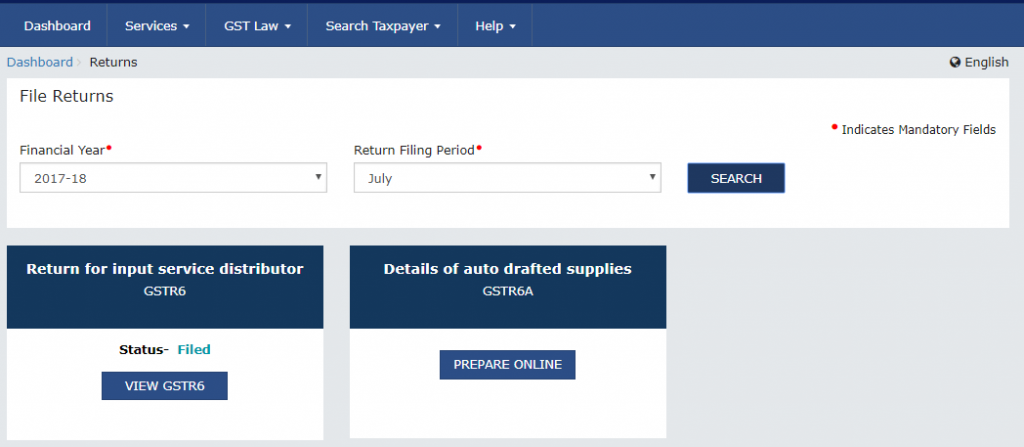

Step 2: Click on ‘RETURN DASHBOARD’.

Step 3:

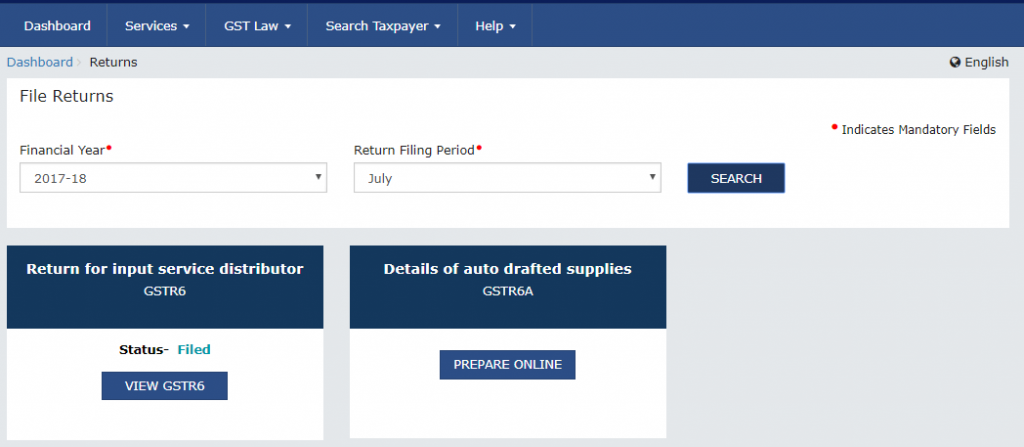

Step 3: Select the month and year of filing form the drop-down and click on ‘SEARCH’.

Step 4:

Step 4: There will be only 2 tiles on the screen. On the tile ‘Return for input service distributor GSTR6’ click on ‘PREPARE ONLINE’.

Step 5:

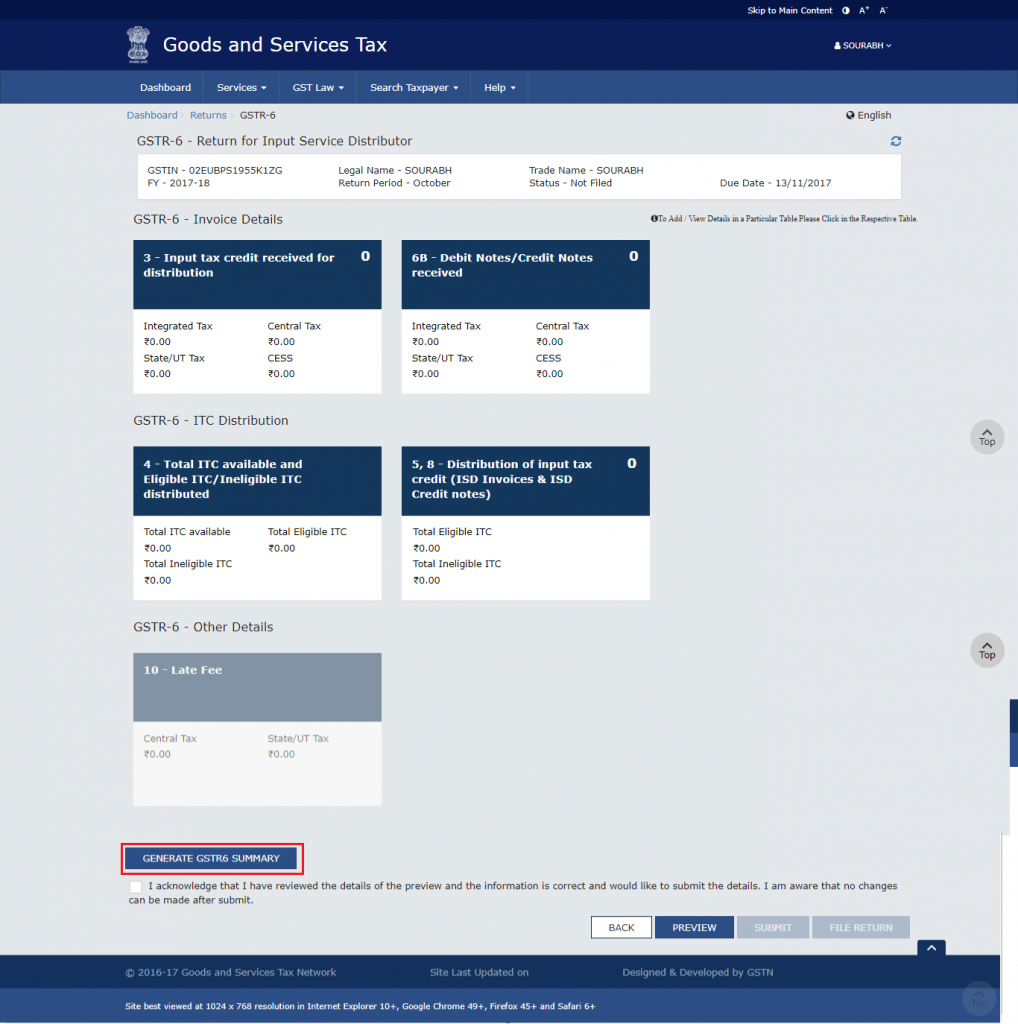

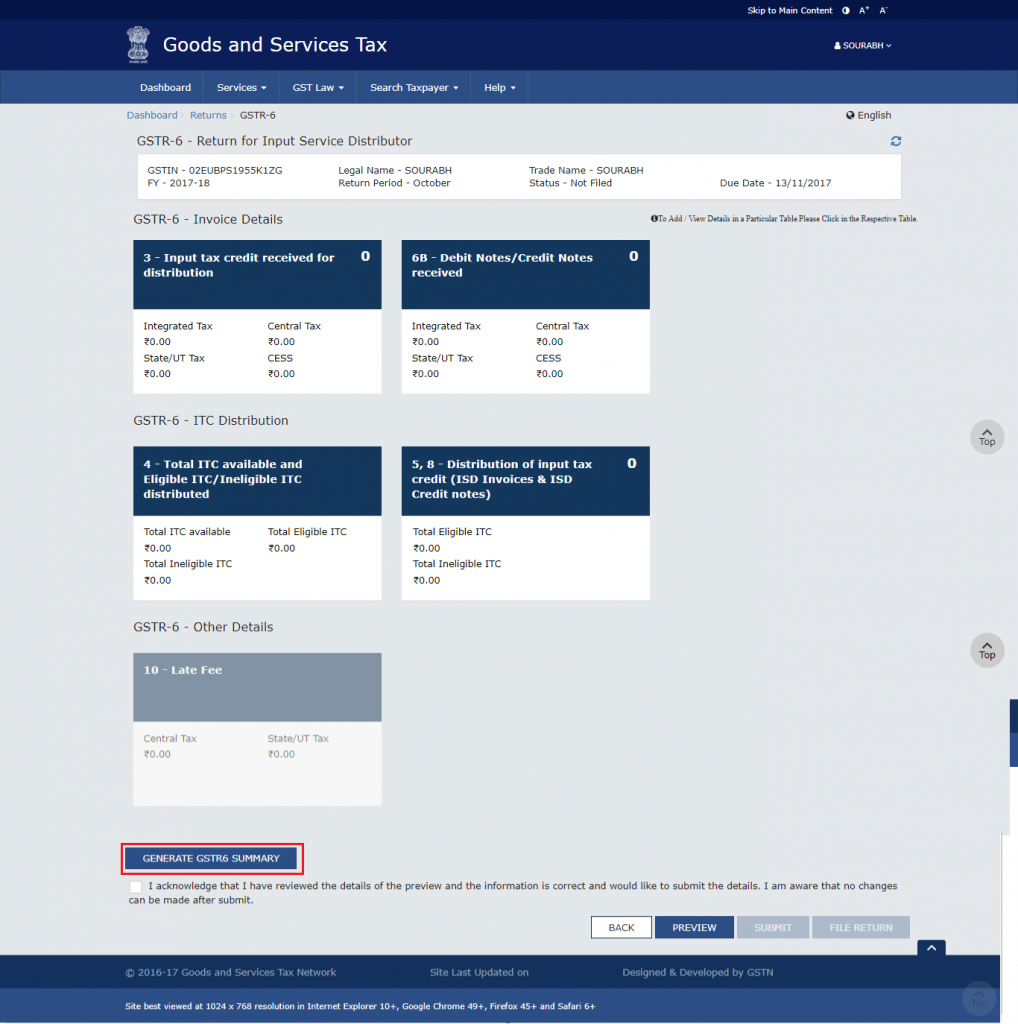

Step 5: Scroll down to the bottom of the page. Click on ‘GENERATE GSTR6 SUMMARY’.

A confirmation message is displayed. The details are auto-populated in some time.

Note: This is an important step. By clicking on this button the details in

GSTR-06A will be auto-populated in your GSTR-06. GSTR-06A is a document that contains all the details of your inputs filed by your suppliers in GSTR-1 & GSTR-05.

Step 6: 3 – Input tax credit received for distribution Once the details are auto-populated you need to click on ‘3 – Input tax credit received for distribution’. You should be able to see a list of GSTIN of vendors from whom you have purchased supplies. Verify the details by going into each vendor by clicking on the GSTIN.

There are 5 types of action that can be taken here-

- Modify Invoices added by Supplier – This action should be taken when some details on the invoice are not correct. Click on the ‘Edit’ icon. Make the changes in the invoice details are per your records. Click on ‘SAVE’.

- Accept Invoices added by Supplier – When the details as per your records match with the details as provided by your supplier you can accept invoices. Select the checkbox beside each invoice and click on ‘ACCEPT’ button.

- Reject Invoices added by Supplier – When all the details in an invoice appear to be incorrect as per your records you can reject the invoice. Select these invoices by clicking on the checkbox an click on the ‘REJECT’ button.

- Keep Pending Invoices added by Supplier – This action should be taken when you are not sure about certain details on the invoice. Select the invoices and click on ‘PENDING’ button.

- Add missing invoice details not added by Supplier – In case some invoices have been missed by your supplier you can add them by clicking on ‘ADD MISSING INVOICE DETAILS’. Fill in the details and click on ‘SAVE’ button.

Note: These actions can be taken and changed any number of times before filing the return.

Step 7: 6B – Debit Notes/ Credit Notes Received

Step 7: 6B – Debit Notes/ Credit Notes Received This tile contains the details of all the Debit and Credit Notes filed by your supplier. The action to be taken here is same as the above step. Accept, Reject, Modify, Pending or Add Invoice in this step.

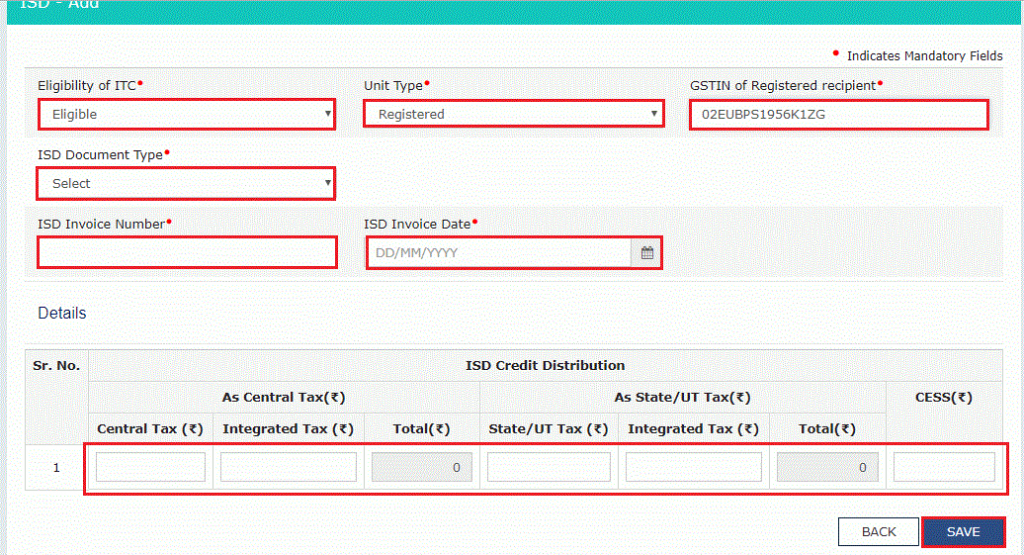

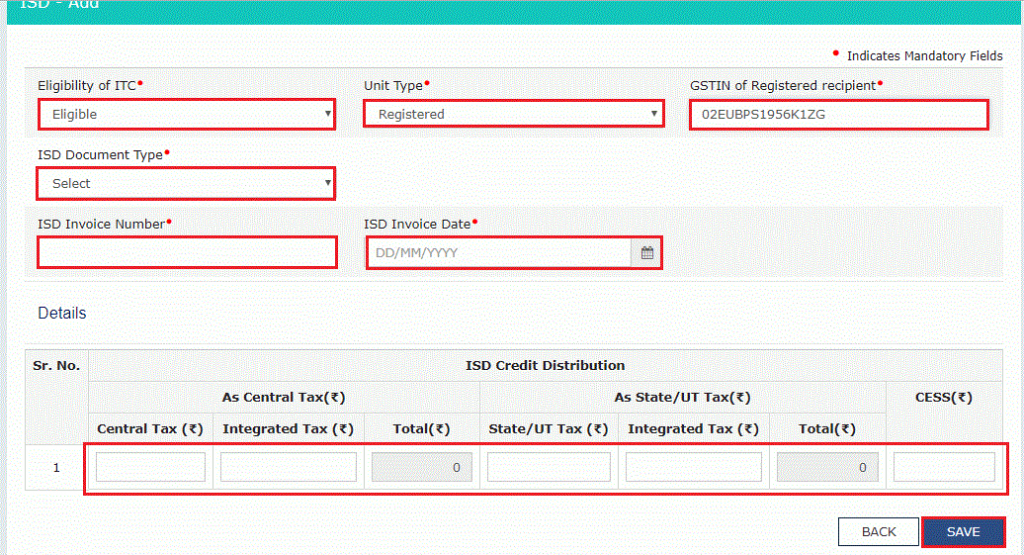

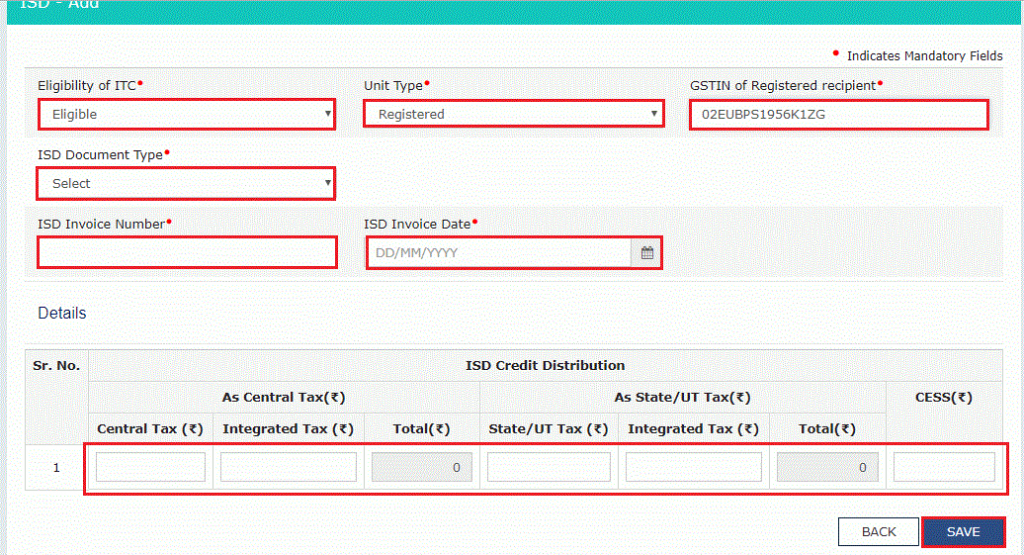

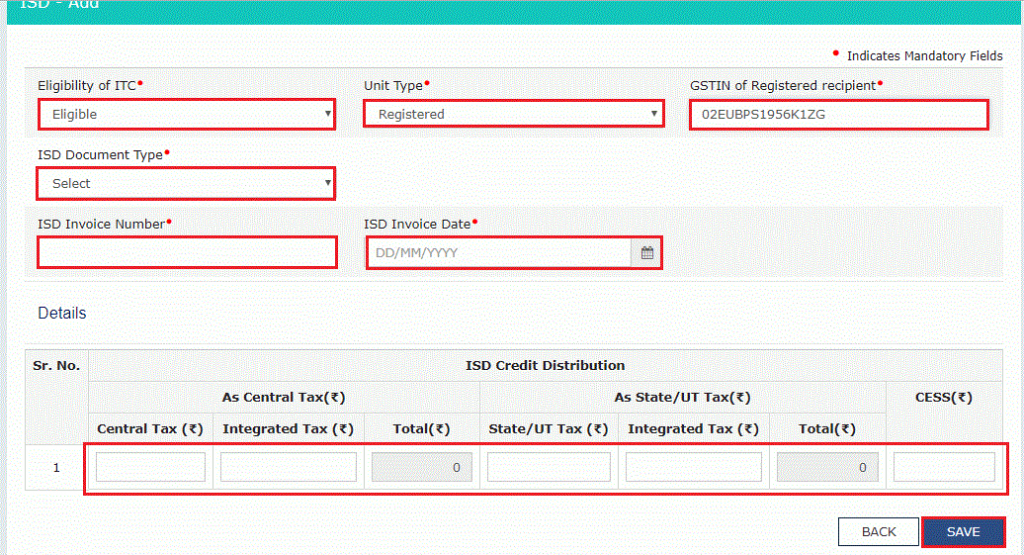

Step 8: 5, 8 – Distribution of input tax credit (ISD Invoices & ISD Credit notes) This is one of the most important steps in filing GSTR-06. Click on ‘Add Document’. Enter the following details:

- Eligibility of ITC: Whether the ITC being distributed is eligible or ineligible for credit

- Unit Type: Registered or unregistered unit

- GSTIN of the Registered recipient

- ISD Document Type: Invoice or Credit Note

- Invoice Number, Date of Invoice, Credit Note Number and Date (if applicable)

- Tax amount

Click on ‘SAVE’ button after entering all the details.

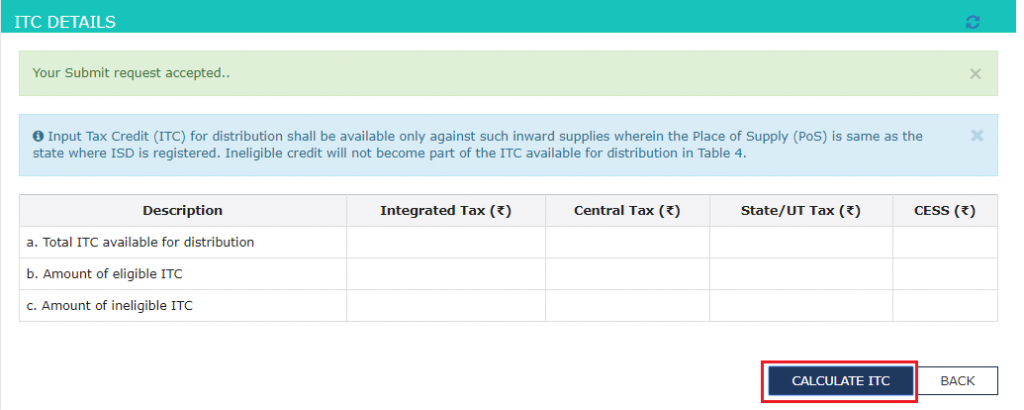

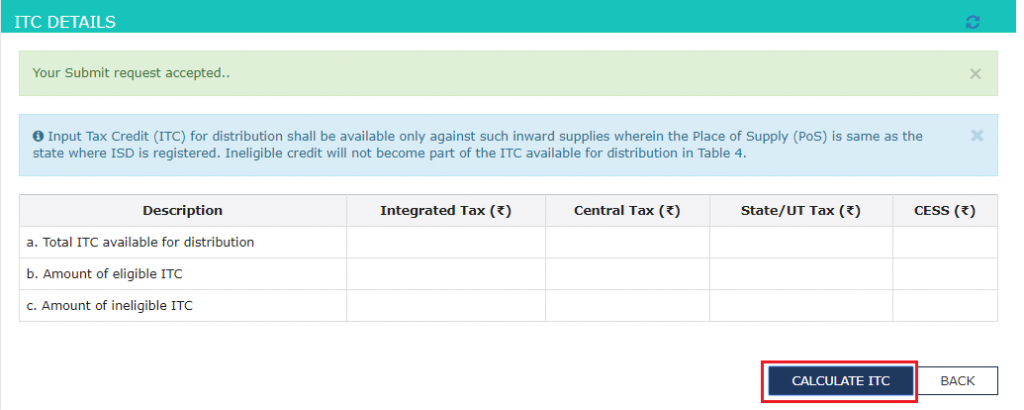

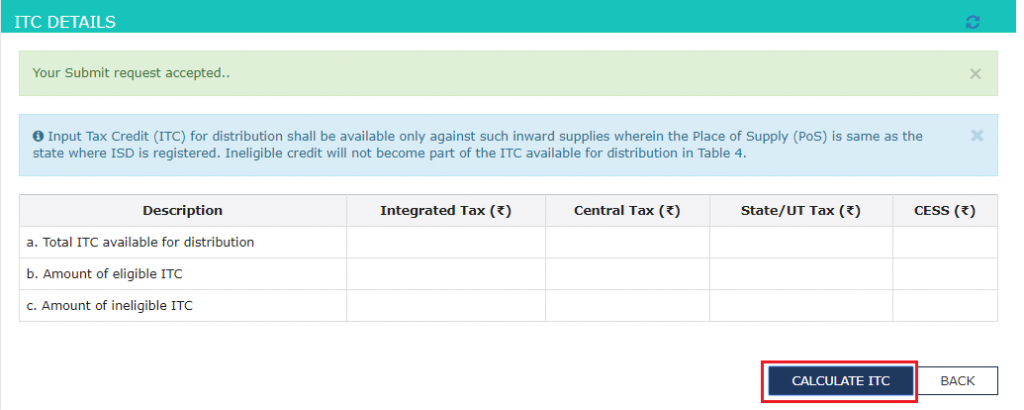

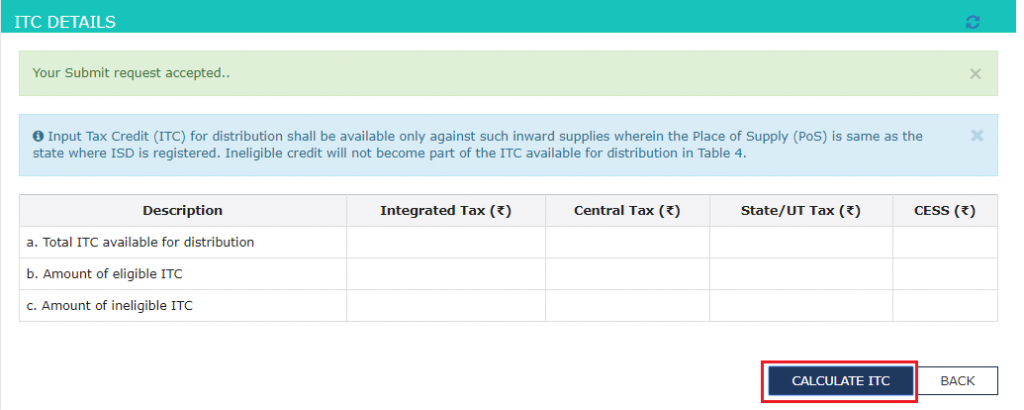

Step 9: 4 – Total ITC available and Eligible ITC/Ineligible ITC distributed:

Step 9: 4 – Total ITC available and Eligible ITC/Ineligible ITC distributed: Click on ‘CALCULATE ITC’. This will display the total ITC, eligible ITC and Ineligible ITC.

Step 10:

Step 10: Preview and Submit the return. Once the return is filed the status of the return on ‘RETURN DASHBOARD’ gets changed to ‘Filed’.

Step 3: Select the month and year of filing form the drop-down and click on ‘SEARCH’.

Step 3: Select the month and year of filing form the drop-down and click on ‘SEARCH’. Step 4: There will be only 2 tiles on the screen. On the tile ‘Return for input service distributor GSTR6’ click on ‘PREPARE ONLINE’.

Step 4: There will be only 2 tiles on the screen. On the tile ‘Return for input service distributor GSTR6’ click on ‘PREPARE ONLINE’. Step 5: Scroll down to the bottom of the page. Click on ‘GENERATE GSTR6 SUMMARY’.

Step 5: Scroll down to the bottom of the page. Click on ‘GENERATE GSTR6 SUMMARY’. A confirmation message is displayed. The details are auto-populated in some time. Note: This is an important step. By clicking on this button the details in GSTR-06A will be auto-populated in your GSTR-06. GSTR-06A is a document that contains all the details of your inputs filed by your suppliers in GSTR-1 & GSTR-05. Step 6: 3 – Input tax credit received for distribution Once the details are auto-populated you need to click on ‘3 – Input tax credit received for distribution’. You should be able to see a list of GSTIN of vendors from whom you have purchased supplies. Verify the details by going into each vendor by clicking on the GSTIN.

A confirmation message is displayed. The details are auto-populated in some time. Note: This is an important step. By clicking on this button the details in GSTR-06A will be auto-populated in your GSTR-06. GSTR-06A is a document that contains all the details of your inputs filed by your suppliers in GSTR-1 & GSTR-05. Step 6: 3 – Input tax credit received for distribution Once the details are auto-populated you need to click on ‘3 – Input tax credit received for distribution’. You should be able to see a list of GSTIN of vendors from whom you have purchased supplies. Verify the details by going into each vendor by clicking on the GSTIN.

There are 5 types of action that can be taken here-

There are 5 types of action that can be taken here- Step 7: 6B – Debit Notes/ Credit Notes Received This tile contains the details of all the Debit and Credit Notes filed by your supplier. The action to be taken here is same as the above step. Accept, Reject, Modify, Pending or Add Invoice in this step. Step 8: 5, 8 – Distribution of input tax credit (ISD Invoices & ISD Credit notes) This is one of the most important steps in filing GSTR-06. Click on ‘Add Document’. Enter the following details:

Step 7: 6B – Debit Notes/ Credit Notes Received This tile contains the details of all the Debit and Credit Notes filed by your supplier. The action to be taken here is same as the above step. Accept, Reject, Modify, Pending or Add Invoice in this step. Step 8: 5, 8 – Distribution of input tax credit (ISD Invoices & ISD Credit notes) This is one of the most important steps in filing GSTR-06. Click on ‘Add Document’. Enter the following details: Step 9: 4 – Total ITC available and Eligible ITC/Ineligible ITC distributed: Click on ‘CALCULATE ITC’. This will display the total ITC, eligible ITC and Ineligible ITC.

Step 9: 4 – Total ITC available and Eligible ITC/Ineligible ITC distributed: Click on ‘CALCULATE ITC’. This will display the total ITC, eligible ITC and Ineligible ITC. Step 10: Preview and Submit the return. Once the return is filed the status of the return on ‘RETURN DASHBOARD’ gets changed to ‘Filed’.

Step 10: Preview and Submit the return. Once the return is filed the status of the return on ‘RETURN DASHBOARD’ gets changed to ‘Filed’.

No comments:

Post a Comment

HAPPY TO HELP YOU ANY TIME ANYWHERE AND IF YOU WANT TO LEARN ANYTHING FROM US YOU CAN REACH US AT SONIKA987@GMAIL.COM