How to e file TDS return

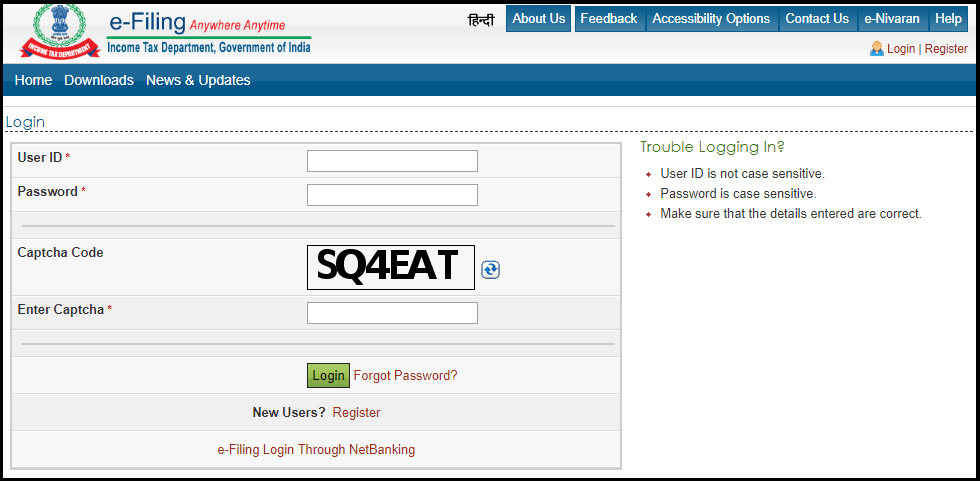

Step-1 Visit the Income Tax Department website and click on Login. Enter your login credentials.

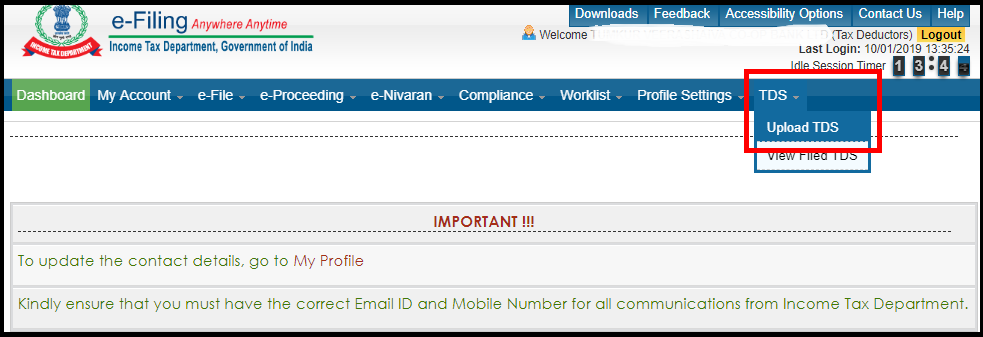

Step-2 After login, Go to TDS then click on Upload TDS option.

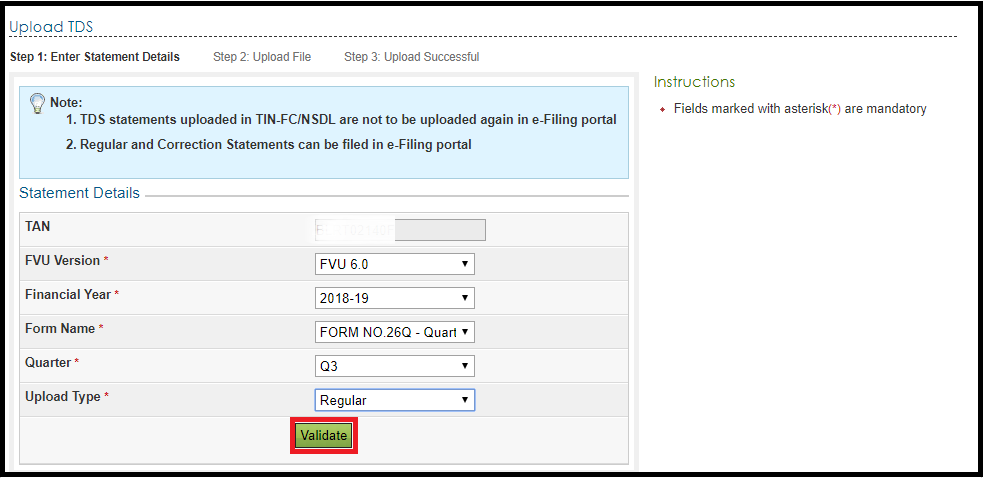

Step-3 Next, enter the Statement details and click on Validate.

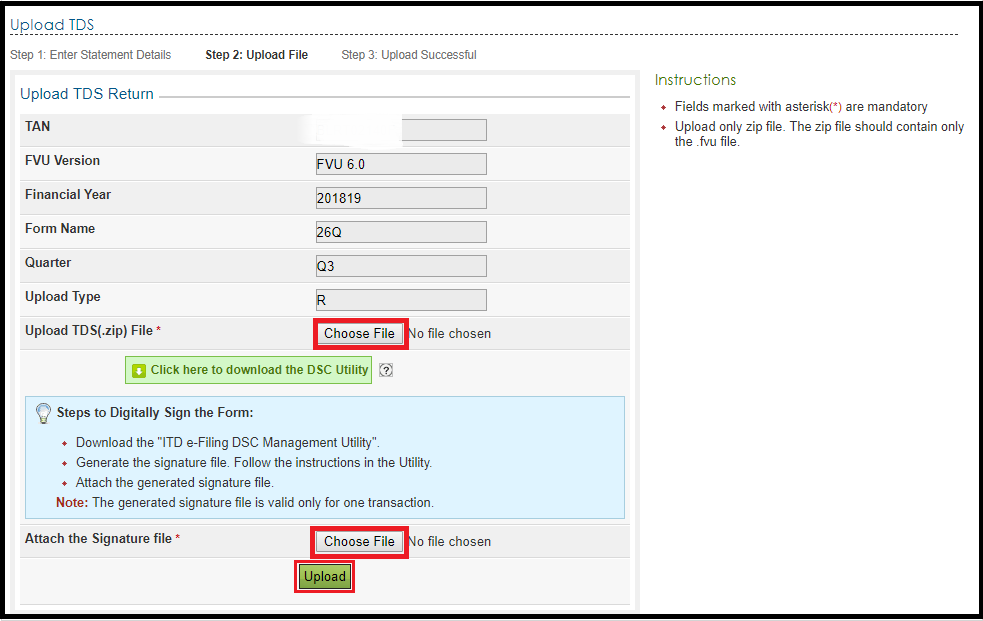

Step-4 Upload the TDS zip file prepared using the utility downloaded from tin-NSDL Website. Then, attach the signature file generated using DSC management utility for the uploaded TDS zip file. For more details on generating DSC click here.

Next, click on the Upload button.

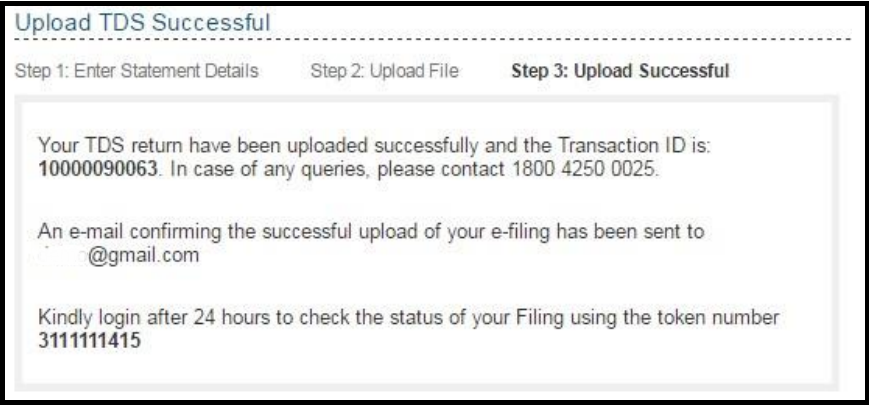

Step-5 Once the TDS is uploaded, a success message will be displayed on the screen. A confirmation mail is sent to your registered mail ID.

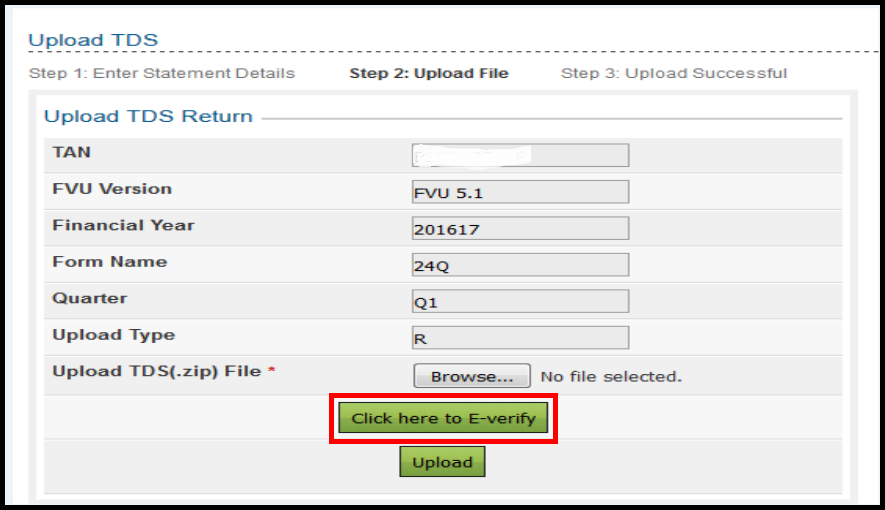

Step-6 The below screen appears if DSC is not generated. Then the users have to click on “Click here to e-verify” to e-verify TDS.

Verification options available

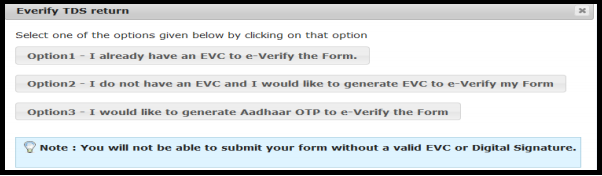

Step-7 The users have these three options to verify as shown below.

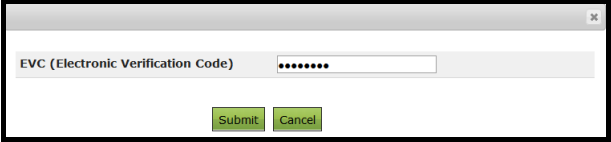

If the users select “Option 1- I already have an EVC to e-verify the Form“, the below screen appears. Enter the EVC (Electronic Verification Code) and click on Submit.

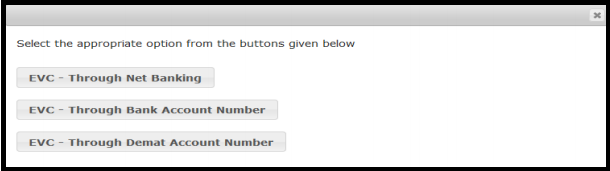

If the user selects “Option 2- I do not have an EVC and I would like to generate EVC to e-Verify my Form” the following screen appears. Select the appropriate option from the screen.

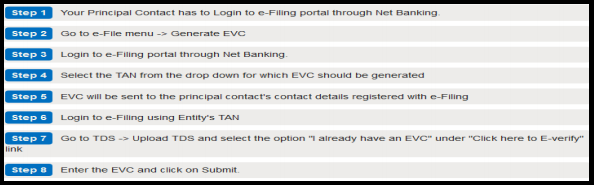

So, follow the below steps for EVC – Through Net Banking.

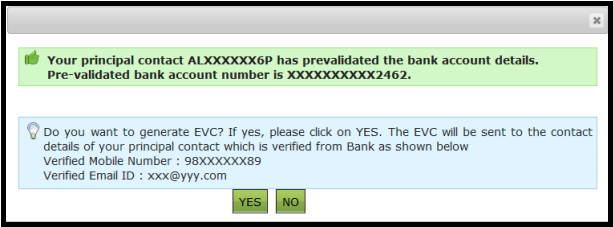

EVC – Through Bank Account Number – To generate EVC through Bank account Number you need to pre-validate the bank details.

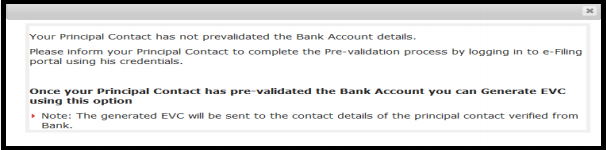

If the Principal Contact has not pre-validated the Bank Account Number, the following screen appears.

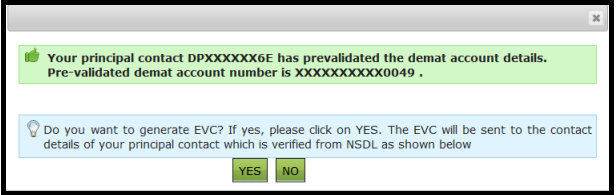

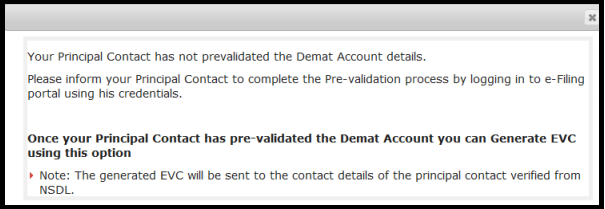

EVC – Through Demat Account Number – The Demat account details of the Principal contact should be pre-validated.

If you have not pre-validated the following screen appears.

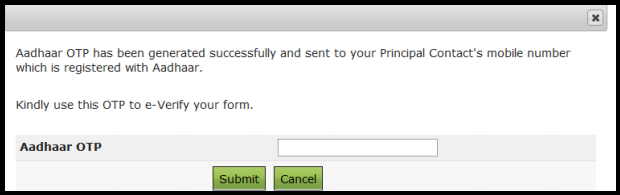

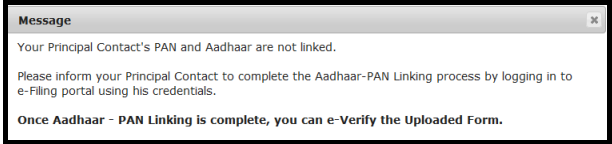

If the user selects “Option 3- I would like to generate Aadhaar OTP to e verify the Form”, the principal contact has to complete the Aadhaar-PAN linking process. The Aadhaar OTP is sent to the principal contact’s Mobile Number. Enter the Aadhaar OTP and Click on Submit.

You will get the below “Message” if principal contact’s Aadhar is not linked with PAN.

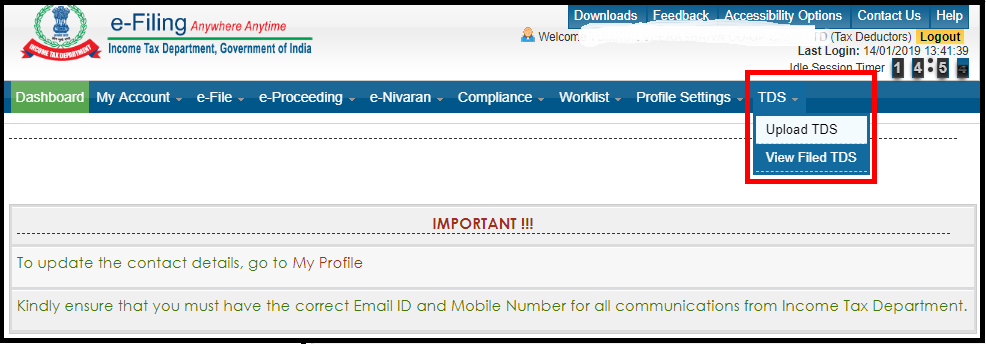

To view the TDS Statement

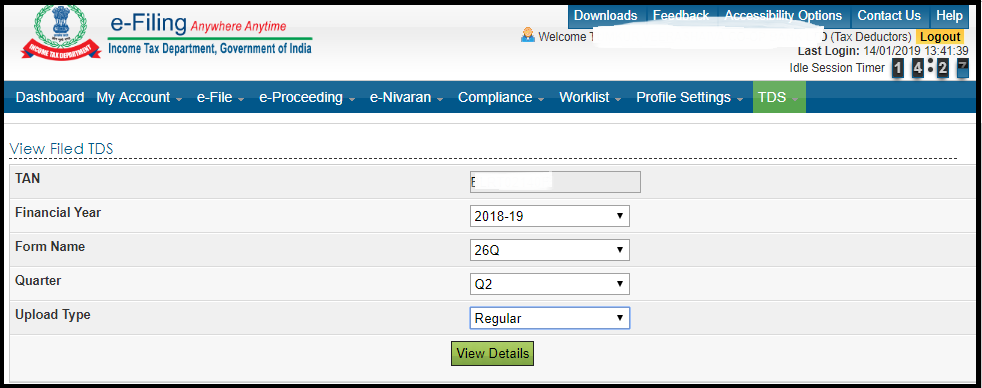

Step-8 To view the filed TDS statement Login to e-filing, Go to TDS and click on View filed TDS.

Step-9 Select the details from the drop-down for which TDS was uploaded. Then, click on “View Details“.

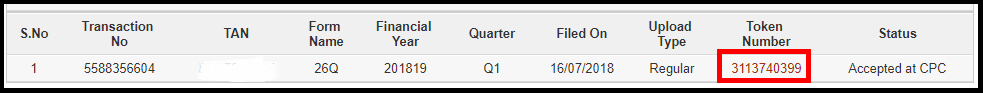

Step-10 The status of the details will be displayed.

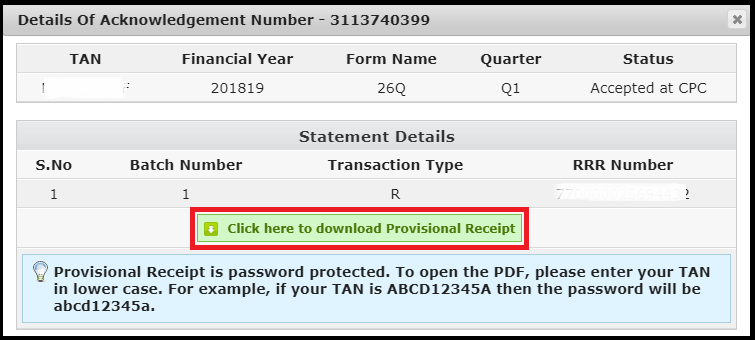

Step-11 In case of “Accepted“, click on the Token Number and download the Provisional receipt as follows.

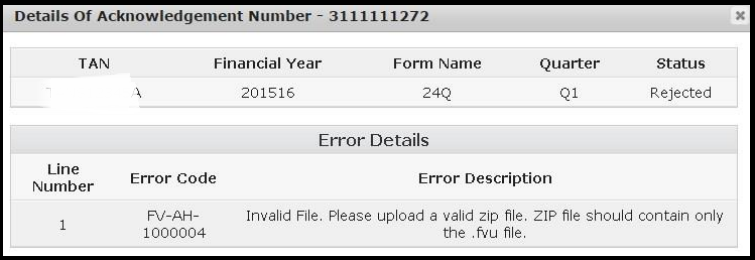

Step-12 In case if “Rejected” Click on the token and view the details of the error as shown below.

No comments:

Post a Comment

HAPPY TO HELP YOU ANY TIME ANYWHERE AND IF YOU WANT TO LEARN ANYTHING FROM US YOU CAN REACH US AT SONIKA987@GMAIL.COM